download PDF version - To read a PDF file you need to install

Adobe Acrobat Reader:

January 2026

Dear Clients and Friends,

Ultimately, the stock market is all about corporate earnings. The second consideration is how much investors are willing to “pay” for those earnings (often denoted by the price-earnings or P/E ratio).

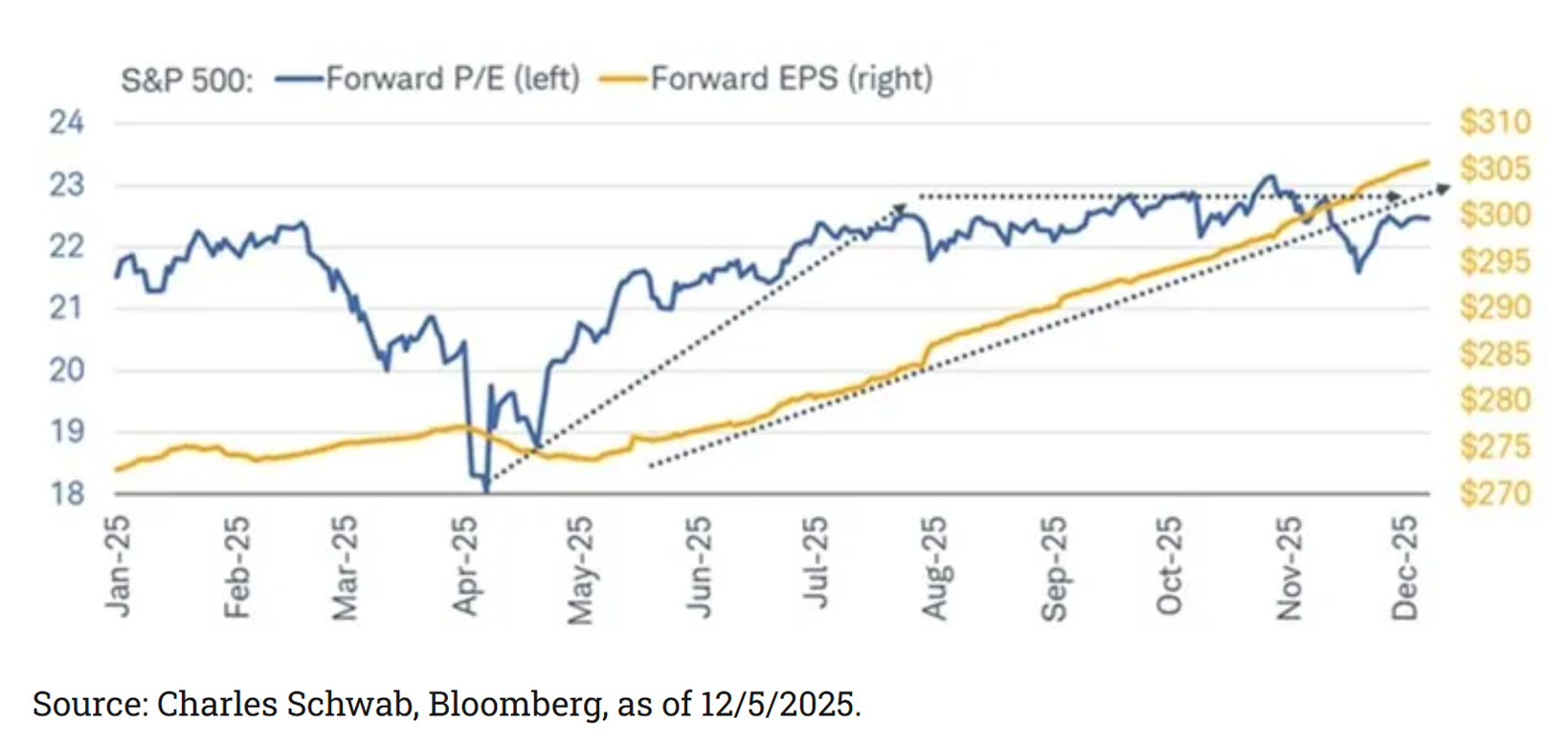

In 2025, corporate earnings took flight as enormous capital spending to build AI-related facilities gathered steam. The chart below shows the surge in earnings (yellow line) while the P/E ratio (blue line) stayed relatively flat after falling sharply in March/April.

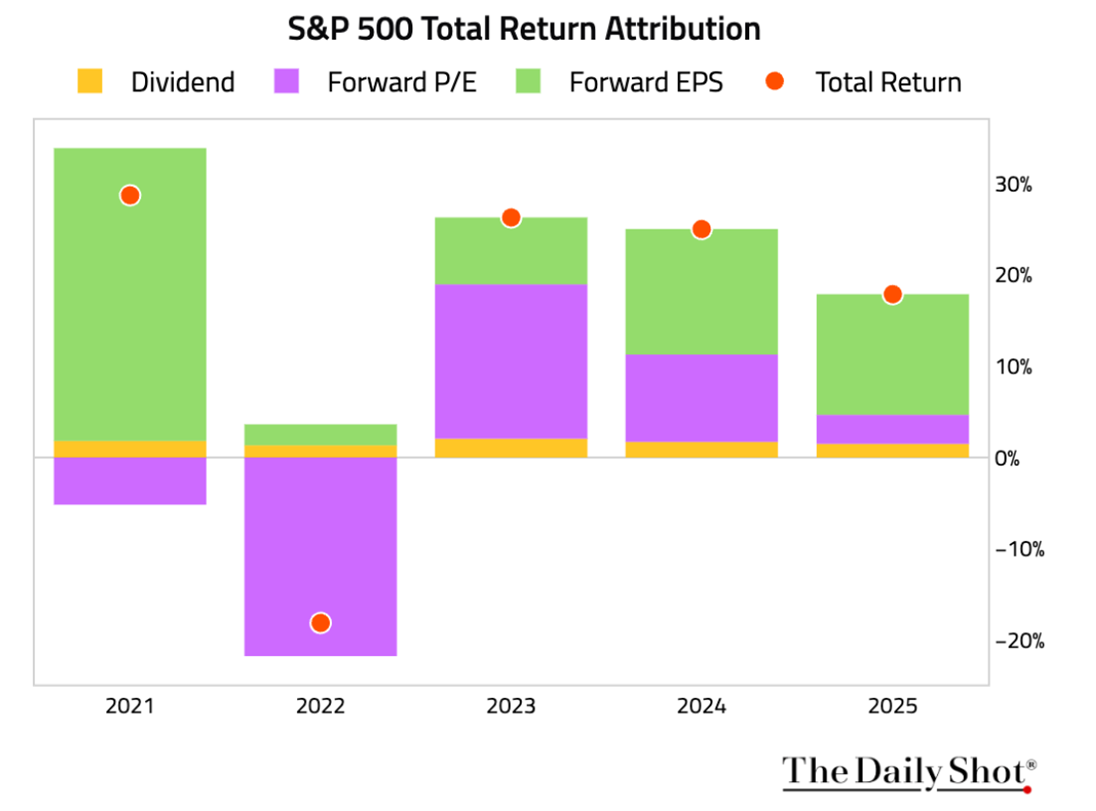

Looked at slightly differently, the chart below shows the share of stock market return driven by corporate earnings (green boxes) and the multiple investors are willing to pay for those earnings (purple box). We see that in 2025 it was almost entirely corporate earnings that drove the market higher. Earnings are expected to grow again, and perhaps even faster, in 2026. Thus, stock market indexes have continued their upward path so far in the new year.

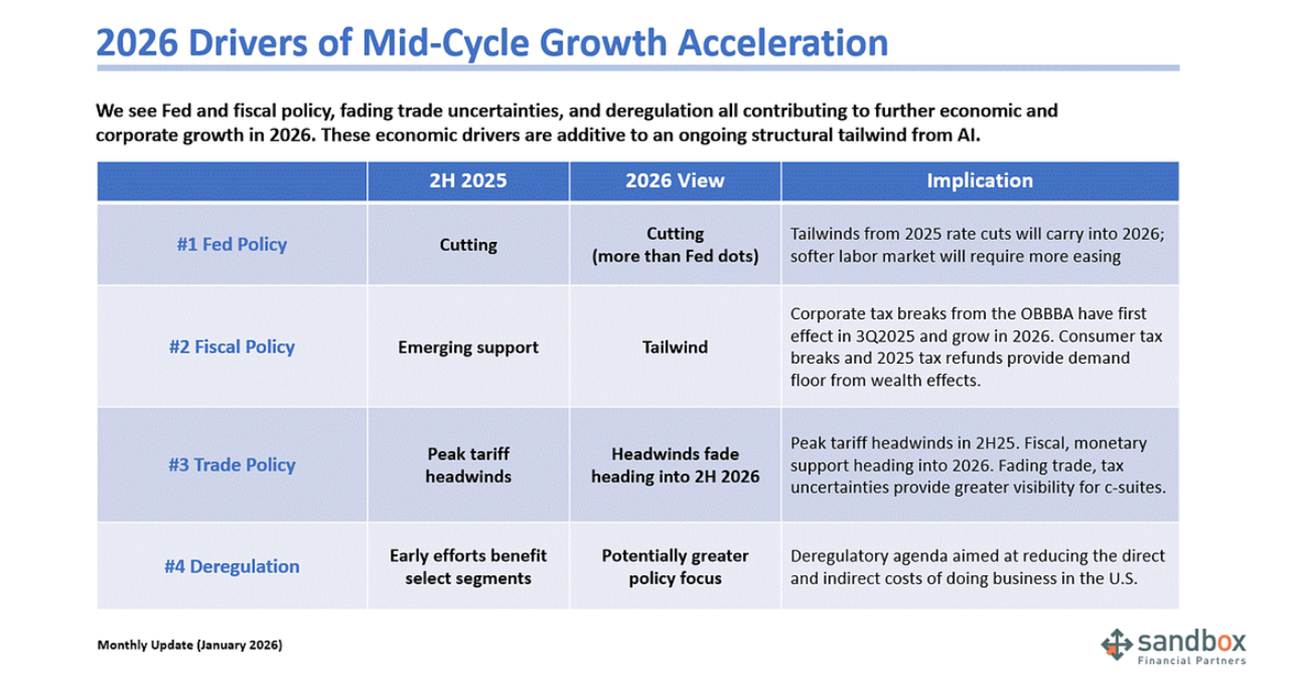

Fueling those higher earnings projections are some of the following factors, summarized as 1) falling interest rates, 2) tax breaks, 3) fading impact of tariffs, 4) relaxed regulatory environment:

Market reactions thus far indicate that the first item, Fed Policy, may not deliver the expected boost investors have wished for. Despite three Federal Reserve rate cuts since September of last year, the market rate for the US 10 year Treasury has not budged and has actually trended higher reflecting the bond markets rejection of ballooning US deficits. What is clear is that any hiccup in earnings growth will result in stock investors reassessment of what stocks are worth going forward.

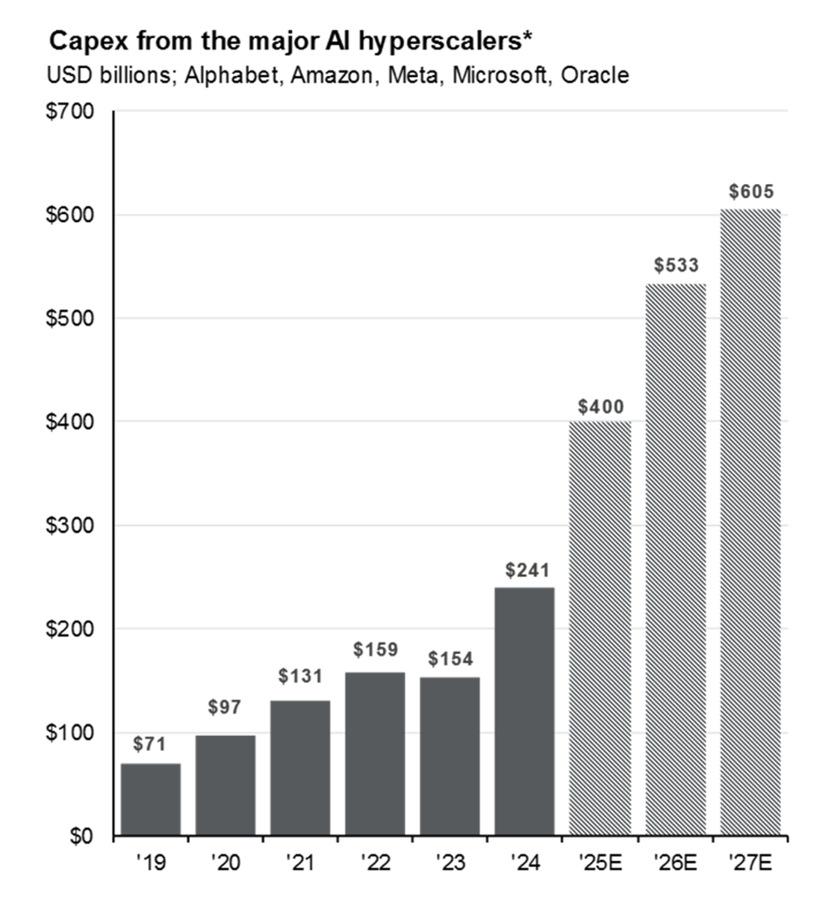

The investment in AI data centers is extraordinary with broad and unknown ramifications for many areas of the economy. The ripple-effect on industrial, material, and utilities providers has been immense. This spending has been a huge force in U.S. economic growth and, thus, the stock market’s performance over the past couple of years. That spending is projected to grow further in 2026.

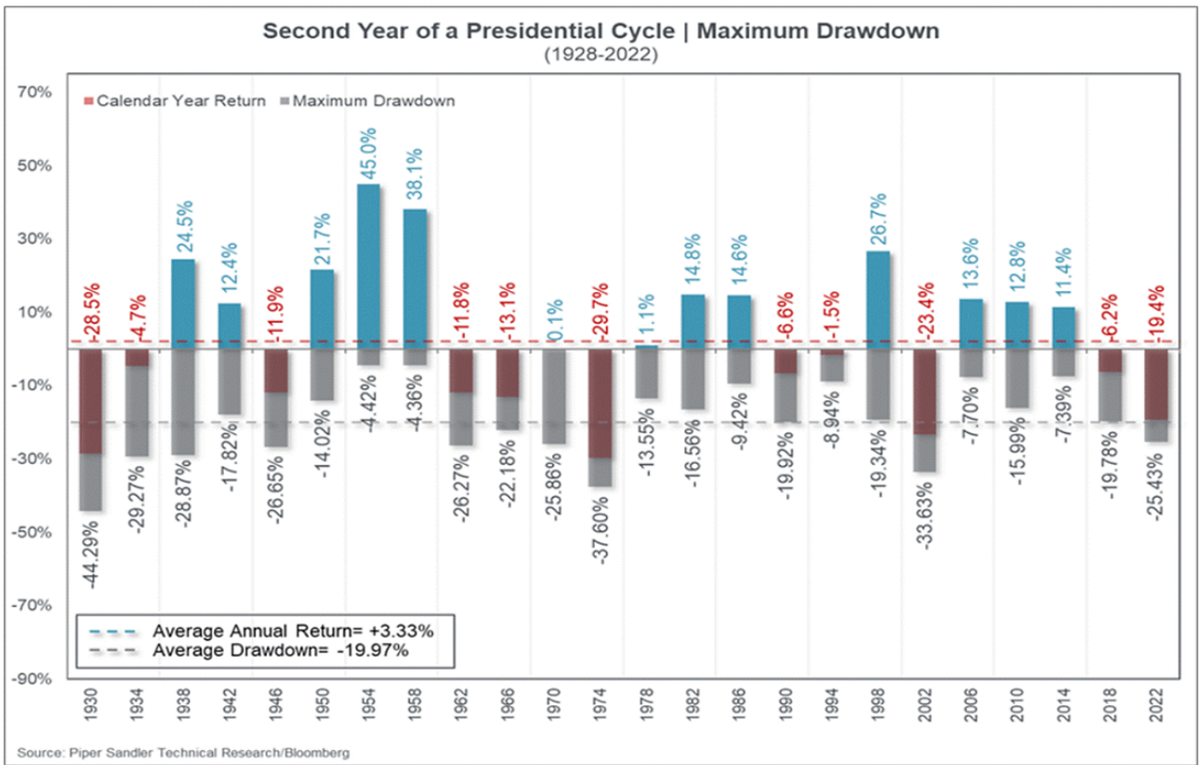

While many of the above trends suggest a positive stock market experience in 2026, there are some counterpoints to consider. As we saw in 2025, market returns are never delivered in a straight line. Indeed, stocks were down -19% in April 2025 before rebounding sharply. Historically, mid-term election years tend to be significantly more volatile as uncertainty builds toward the November elections. The downward bars on the chart below show the magnitude of mid-year market declines in the market. The average of -20% is hefty and something to be cognizant of.

As a result of the stock market’s inherent volatility, we always believe in a nimble approach to investing, becoming defensive when stocks are falling. The damage a sharp downside market can deliver to our portfolios, especially later in our investing life, is simply too great to ignore. Thus, we manage with one foot poised on the brake in case something comes along to imperil our upward path. We look forward to continuing to protect and grow your wealth in 2026.

To future profits,

Don Lansing Chief Investment Officer. 512-289-0620 |

Garrett Beauvais Portfolio Manager 512-796-0233 |

download PDF version - To read a PDF file you need to install Adobe Acrobat Reader:

Thank you for your time and interest!

To obtain more information or to schedule a FREE personal consultation so you may fully understand the benefits our clients receive, please contact us at:

| Phone: | (512) 255-8722 |

| Email: | info@markettrendadvisors.com |

| Business hours: | Monday through Friday 8:00am to 5:00pm Central Standard Time |

MARKETTREND Advisors, Ltd.

9508 Topridge drive

Austin TX 78750

MarketTrend Advisors is an investment advisory firm that specializes in the trend-following strategies outlined in this report. We offer a variety of strategies that can be used to build portfolios to meet almost any investment objective. We divide our strategies into two main groups: "Long" strategies and "Trend" strategies. The Trend strategies follow the trend up or down. The "Long" strategies are typical investment portfolios that usually remain fully invested, potentially raising cash or moving to income-focused investments when the market is weak. We have a variety of "Long" strategies depending on how aggressive or conservative you want to be. These strategies will make their money when the market is moving higher. The "Trend" strategies will provide protection in a down market and add to gains in an up-trending market. By combining the Long and Trend strategies you get all the components needed to build a successful long-term portfolio:

- A portfolio invested in the best performing indexes, ETFs, or stocks

- Substantial exposure to global growth through international holdings

- Protection for your overall portfolio from down-trending markets When the market is going up, you benefit as aggressively as you wish.

Disclaimer

- MarketTrend Advisors, Ltd. is an independent registered in the States of California, Florida, New York and Texas.

- Other Securities Industry Affiliations or Activities. MarketTrend Advisors, is not registered as a broker or dealer, nor do we have any partners or employees who are affiliated with any broker or dealer. See Form ADV, Part II for official declarations.

- MTA portfolio strategies assume risk and no assurance is made that investors will avoid losses. No representation is made that clients will or are likely to achieve profits or incur losses comparable to those shown. Performance results are shown for illustration and discussion purposes only. The performance information has not been audited. However, the information presented is believed to be accurate and fairly presented. All performance figures in this presentation are net of management fees and commissions. Management fees are charged to actual client accounts on a monthly basis. Accounts include both taxable and non-taxable IRA accounts.

- Regarding the MTA Blend strategy: This strategy was migrated into the MTA Wealth Builder strategy and closed in December 2008.

- Regarding actual performance: Actual performance for all strategies includes all commissions as well as management fees (fees range from 1% to 2%). Actual performance statistics are based on the inception date of each strategy through the end of the last business day of the most recent month listed in the monthly performance section of this report. Starting with Q4, 2006, returns include only assets of Fidelity clients who were fully invested in their respective strategies. Returns before Q4, 2006 include all Fidelity client assets regardless of investment status. Results do not include the assets of clients at other brokerage firms.

- Regarding future performance: Past performance may not be indicative of future results. Therefore, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to corresponding past performance levels.

- S&P 500 refers to the Standard & Poor's 500 Large-Cap Corporations Index. The index is designed to measure performance of the broad based US market and consists of 500 American companies. This index is used for comparative purposes only. (Data is taken from Yahoo! Finance.)

- MarketTrend Advisors is not liable for the usefulness, timeliness, accuracy, or suitability of any information contained in its web site or of any of its services. The user understands that the information given can and will fail to predict the direction and magnitude of market price movements and the user can lose money when using this information.